What Happened?

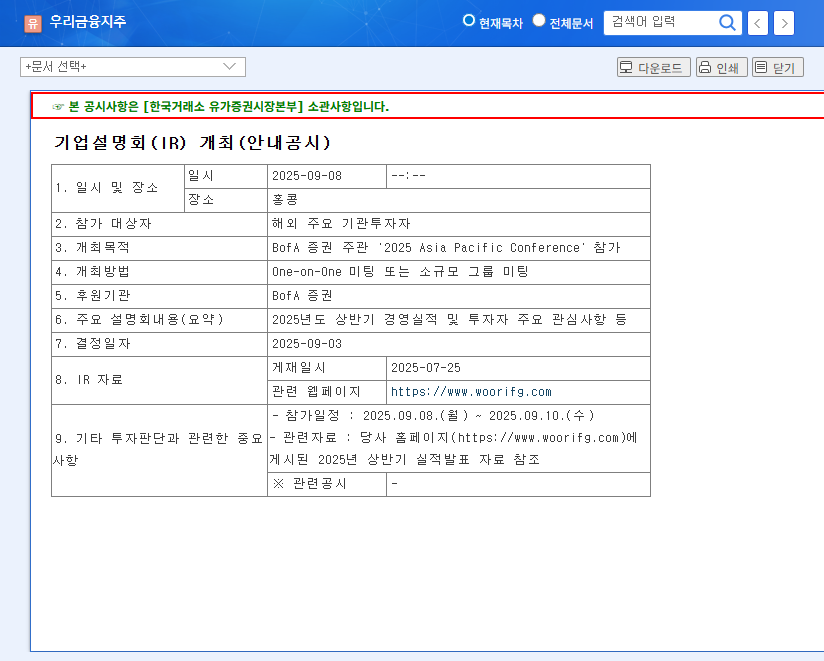

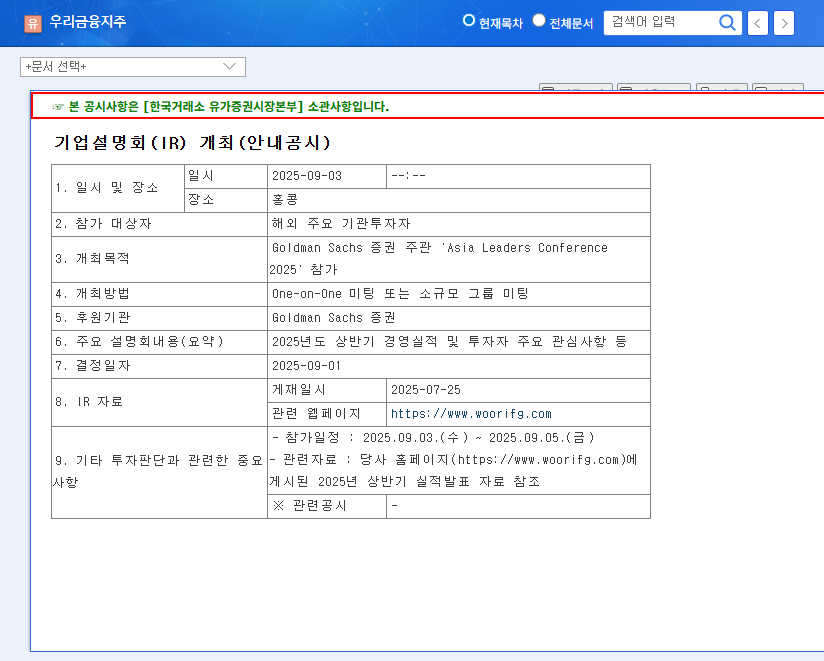

Woori Financial Group will participate in the ‘2025 Asia Pacific Conference’ hosted by BofA Securities on September 8, 2025, and announce its H1 2025 earnings and future growth strategies.

Key Investment Points

- Comprehensive Financial Group Completion: Diversified revenue streams and synergy creation through the establishment of banking, securities, and insurance portfolios.

- Solid Financial Performance: Achieved KRW 1.552 trillion in accumulated net income for the first half, maintaining solid asset growth and stable commission income generation.

- Strengthened ESG Management: Achieved AAA rating in MSCI ESG assessment and inclusion in the DJSI World Index.

Market Outlook and Investment Strategies

The market is paying attention to Woori Financial Group’s growth potential and solid performance as a comprehensive financial group. In particular, past data analysis suggests that positive events such as IR conferences are likely to act as a momentum for stock price increases. However, investors should also be aware of the possibility of a stock price decline if market expectations are not met or macroeconomic volatility increases. Therefore, it is crucial for investors to thoroughly analyze the IR presentation and make investment decisions based on a comprehensive evaluation of synergy effects, future growth strategy execution, and risk management capabilities.

Investor Action Plan

- Analyze conference details and market reactions.

- Evaluate synergy effects as a comprehensive financial group, execution of future growth strategies, and risk management capabilities.

- Make investment decisions considering investment objectives and risk tolerance.

FAQ

How was Woori Financial Group’s performance in the first half of 2025?

Woori Financial Group continued its solid growth, recording KRW 1.552 trillion in accumulated net income for the first half of 2025.

What should I focus on at this conference?

Focus on synergy effects as a comprehensive financial group, execution of future growth strategies, and risk management capabilities.

What are the precautions for investment?

Make investment decisions while considering the possibility of falling short of market expectations or increased macroeconomic volatility.