1. TY Holdings’ Rights Offering: What’s Happening?

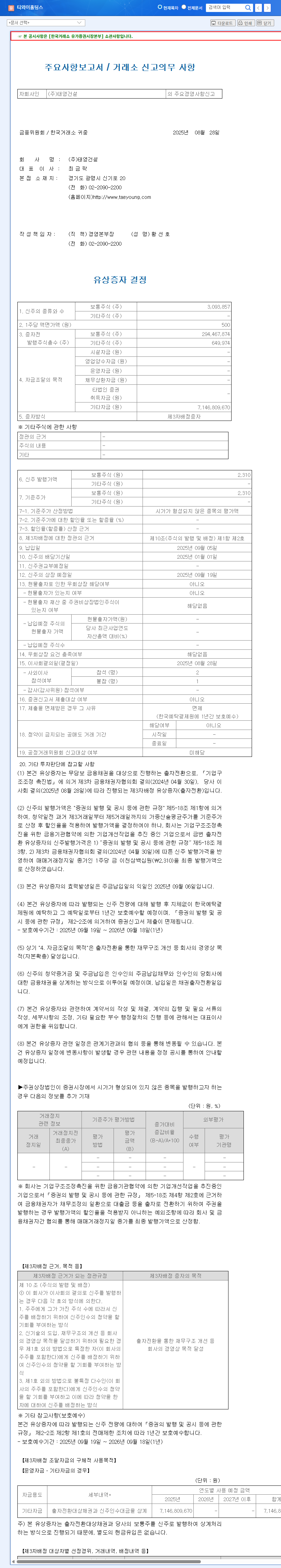

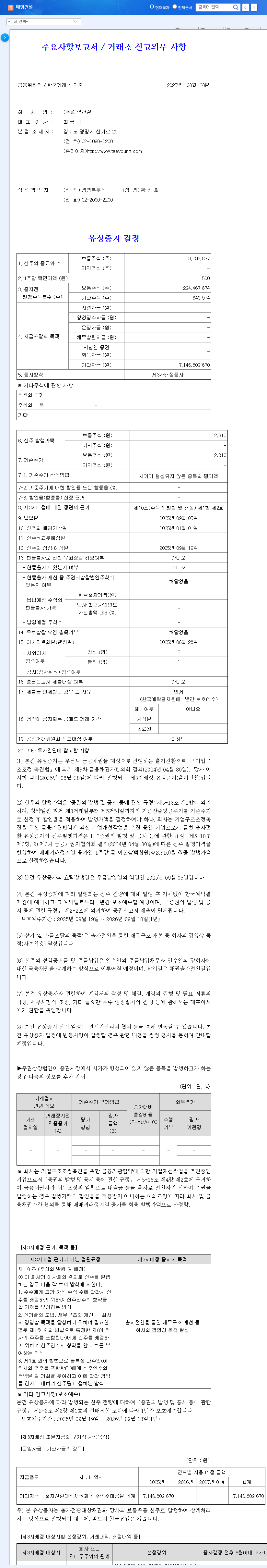

On August 28, 2025, TY Holdings announced a rights offering of 3,093,857 shares, totaling 7.1 billion KRW, for Taeyoung Construction. The payment date is September 5th, and the listing date is September 19th. This move is seen as a capital injection to improve the financial structure of Taeyoung Construction, currently under workout procedures.

2. Why the Rights Offering?

Taeyoung Construction is undergoing a workout process and urgently needs to improve its financial health. This rights offering aims to provide short-term funding to support Taeyoung’s operations and pave the way for its graduation from the workout program. However, concerns remain about whether 7.1 billion KRW is sufficient to address the fundamental issues.

3. Impact on Investors

- Positive aspects: Short-term financial improvement, demonstration of commitment to workout recovery.

- Negative aspects: Share dilution, insufficient to solve fundamental problems, potential need for further funding.

Investors should carefully consider these factors when making investment decisions. Closely monitoring the progress of Taeyoung Construction’s workout and TY Holdings’ further funding plans is crucial.

4. Investor Action Plan

Investors considering TY Holdings should pay attention to the following:

- Monitor Taeyoung Construction’s workout progress.

- Analyze TY Holdings’ financial structure and funding plans.

- Make long-term investment decisions.

- Manage risk through diversified investments.

Frequently Asked Questions

How will this rights offering affect Taeyoung Construction’s workout?

While the short-term funding may increase the likelihood of a successful workout graduation, it may not be enough to resolve the fundamental issues.

Is TY Holdings a good investment now?

The investment decision is up to the individual investor. Carefully analyze the workout situation, financial structure, and other relevant factors before making a decision.

What will happen to the stock price after the rights offering?

In the short term, the share dilution may lead to a price drop. The long-term trend will depend on the workout outcome and the company’s performance.