1. What Happened?

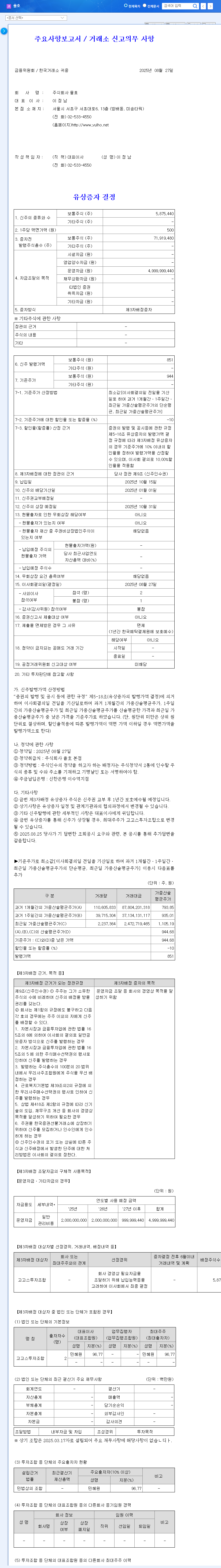

Yulho announced a rights offering of 5,875,440 common shares at a price of 851 KRW per share. This represents approximately 8% of the existing shares, with Gogos Investment Partnership participating as an investor. The payment date is October 15, 2025, and the listing date is scheduled for October 31, 2025.

2. Why the Rights Offering?

Yulho is expanding its portfolio beyond its core IT solutions business into secondary batteries, waste treatment, mineral resource development, and AI. The rights offering aims to secure funding for these new ventures and support operating expenses. The secondary battery business, in particular, holds significant growth potential, driven by a technological partnership with a North American listed company.

3. Opportunity or Risk?

- ✅ Positive Impacts:

- Secures funding for new ventures

- Potential for improved financial structure

- Signals investor confidence

- ❌ Negative Impacts:

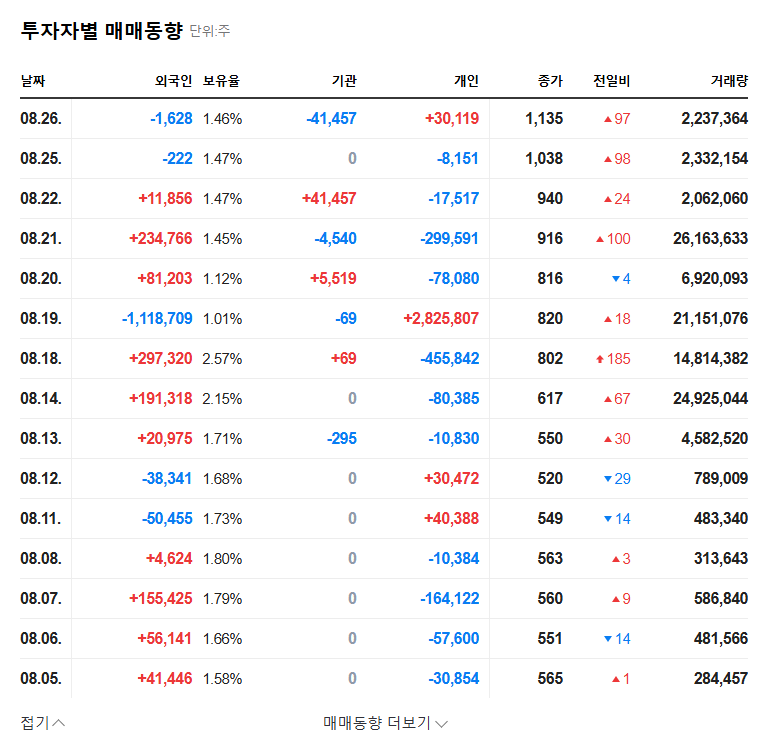

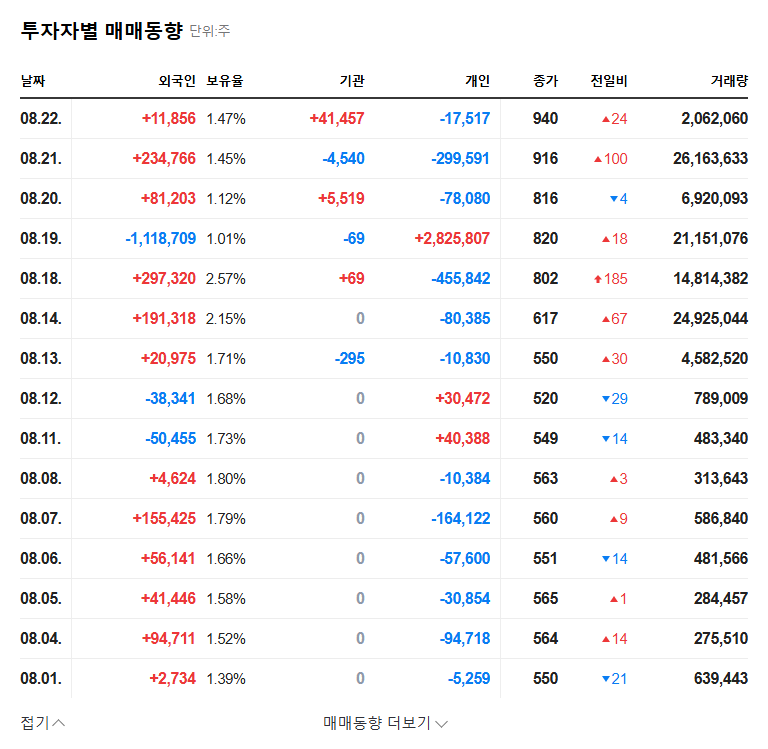

- Share dilution and downward pressure on stock price

- Uncertainty regarding fund utilization and profitability

- Potential gap between market expectations and reality

4. What Should Investors Do?

Yulho’s rights offering presents both growth opportunities and financial risks. Investors should consider the following:

- Growth potential and profitability of new ventures

- Fund allocation plan and efficiency of execution

- Profitability improvement in the core IT solutions business

- Overall macroeconomic environment and currency fluctuations

It is crucial for investors to look beyond short-term stock price volatility and focus on the long-term performance of Yulho’s new businesses and its financial health.

What is the purpose of Yulho’s rights offering?

The rights offering aims to secure funding for investments in new business areas, such as secondary batteries and mineral resource development, as well as to support operating expenses.

How will the rights offering impact Yulho’s stock price?

In the short term, share dilution may put downward pressure on the stock price. However, the long-term impact will depend on the success of the new ventures.

What should investors consider?

Investors should evaluate the growth potential of the new businesses, the company’s fund allocation plan, the profitability of its core business, and the broader macroeconomic environment.