Doosan Enerbility IR: What Happened?

Doosan Enerbility is hosting an IR meeting on September 9, 2025, in conjunction with its participation in the 2025 Asia Pacific Conference. The meeting will cover Q2 2025 earnings results and key management updates, followed by a Q&A session with investors.

Key Analysis: Why Does It Matter?

This IR offers valuable insights into Doosan Enerbility’s current performance and future outlook. Key areas of focus include growth in power plant and EPC orders, progress in new businesses such as SMRs, gas turbines, and aircraft engines, as well as the analysis of risk factors like the global economic slowdown and financial burdens.

Key Investor Takeaways: What Should You Do?

- Positive Factors: Increasing power plant orders, new business growth potential, strong performance of Doosan Bobcat.

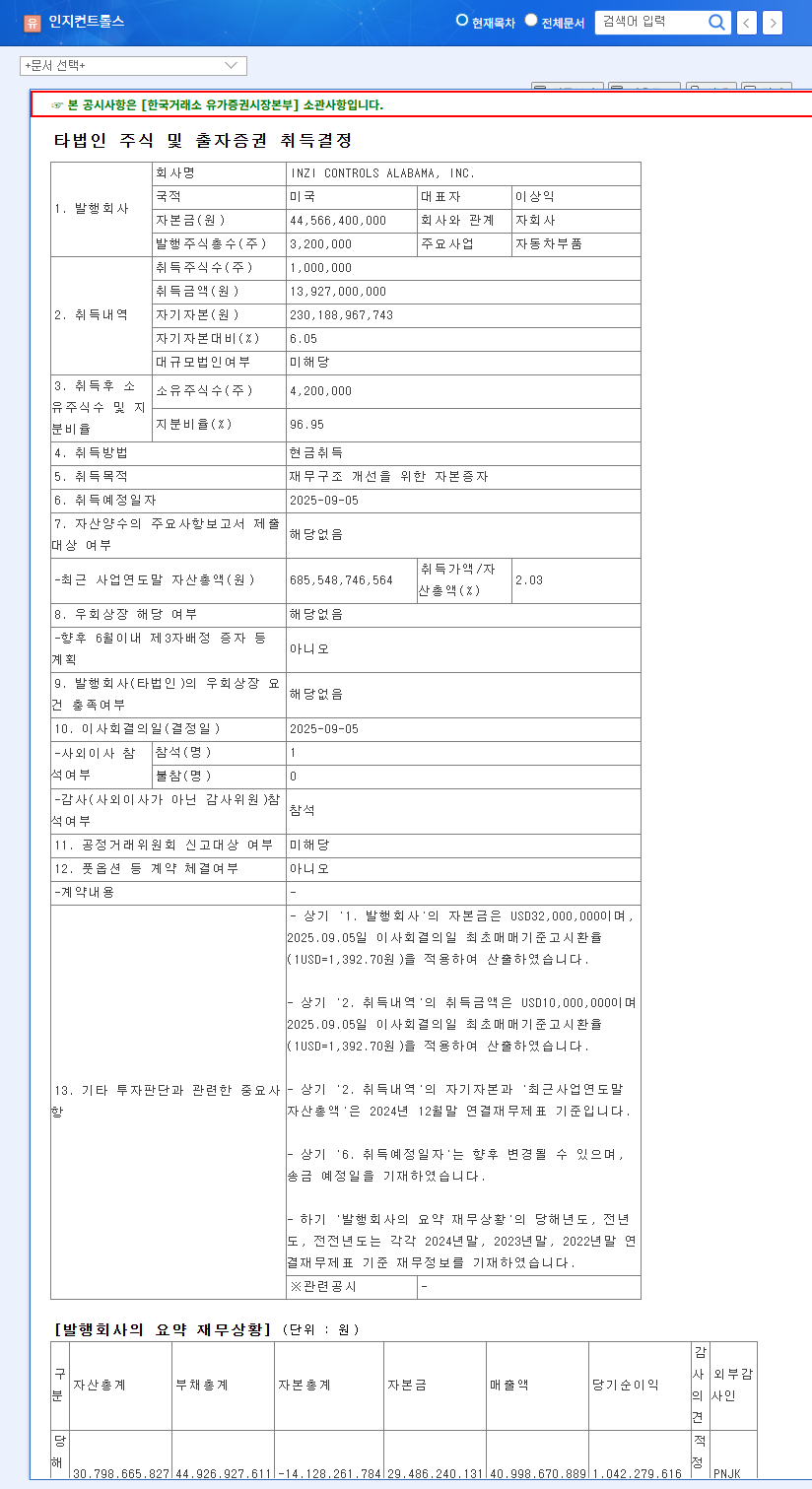

- Negative Factors: Decrease in sales and operating profit, high debt ratio, raw material price volatility, and sluggish performance of Doosan Fuel Cell.

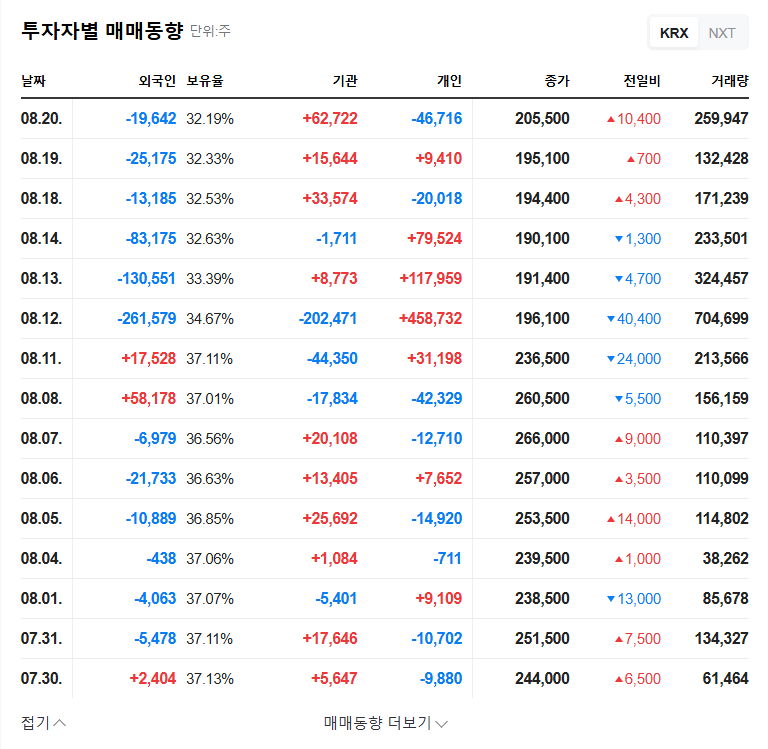

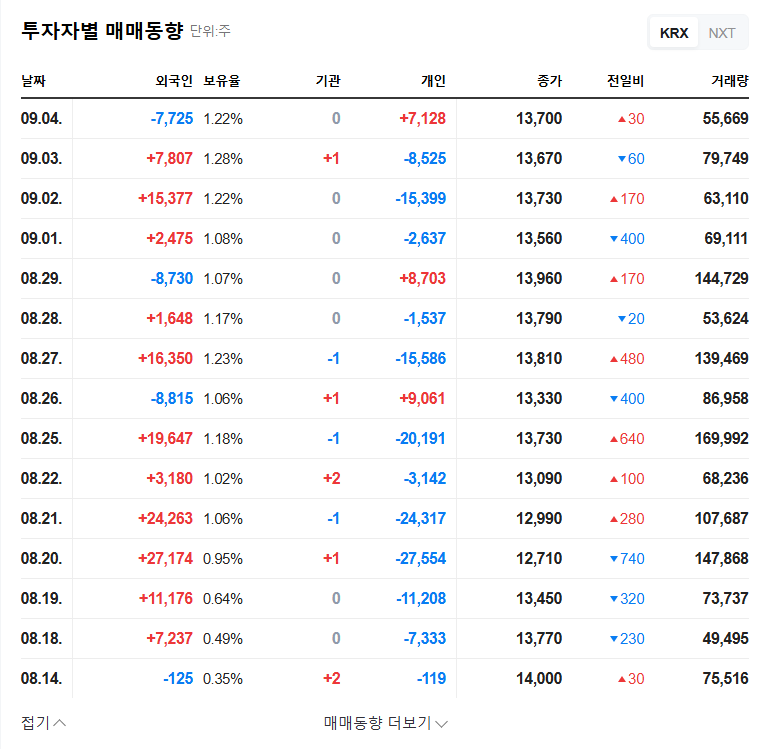

The Q2 earnings results and management’s future outlook, to be announced during the IR, could significantly impact stock price volatility. Investors should carefully analyze the IR details, considering both the company’s long-term growth potential and risk factors before making investment decisions.

Investment Action Plan

- Carefully review the IR presentation: Focus on key information such as earnings, orders, and new business outlook.

- Analyze the Q&A session: Gain further insights from management’s responses to investor questions.

- Continuously monitor risk factors: Keep track of the debt ratio, raw material prices, and exchange rate fluctuations.

- Maintain a long-term perspective: Prioritize long-term growth potential over short-term fluctuations in earnings.

FAQ

What are Doosan Enerbility’s main businesses?

Doosan Enerbility operates various energy businesses, including power plants, EPC, nuclear power, and renewable energy.

What are the key takeaways from this IR?

Focus on the Q2 earnings results, new business growth strategies, and financial improvement plans.

What are Doosan Enerbility’s key risk factors?

Key risk factors include high debt ratio, raw material price volatility, and the global economic slowdown.